Personal Investing Experience

My welcome to the market moment was when I lost $3,000 trading stock options when I didn't know how anything worked and was essentially just gambling. Since then I've continued to learn and improve my knowledge in the financial markets and have continued to invest in my personal portfolio. I've since grown my Roth IRA account by 300% and am up 50% in my crypto portfolio. I've also joined many finance and investment clubs at the University of Miami including SMIF, the school's $2M endowment fund, and the Canes Finance Association.

I've also interned at various buy side digital asset investment firms including Meta4 Capital (NFT Investment and Lending Fund), WWVentures (Web3 Venture Fund), and Arca (Digital Asset Hedge Fund). My internships roles were primarily as investment and research analysts, and I've continued to grow as an analyst in the crypto industry.

I enjoy asset management because of the exciting decision-making process of asset selection, monitoring risks and major market events, and keeping up with innovative market trends that are interesting to learn about.

Feel free to check out my resume via the navigation bar!

Macroeconomic Take

I am quite bullish on the current macro environment today. With a potential rate cut by mid Decemeber, an increasing global liquidity (M2 money supply), resilent consumer spending, the 10Y treasury rate decreasing and is now under 4.2%, and inflation remaining relatively static at a annual rate of 2.6% - I believe the market, especially for risk-on assets, will continue to trend higher until Q2 - Q3 2025. I do believe there is a 20% chance of a recession by end of next year primarily driven by the pullback of consumer spending as credit continues to tighten and jobless claims begin to slowly rise.

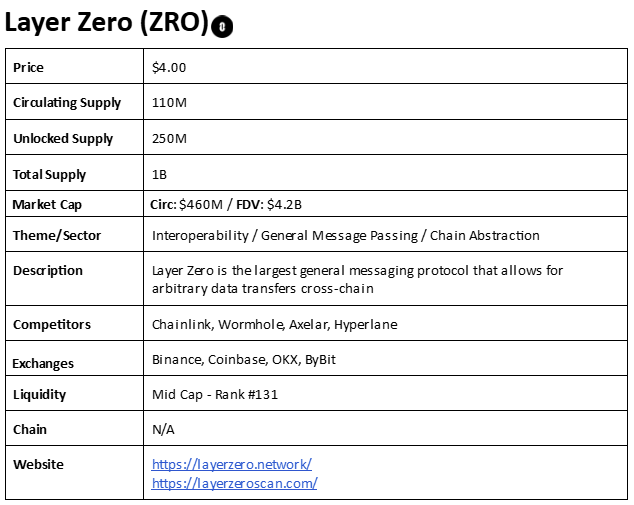

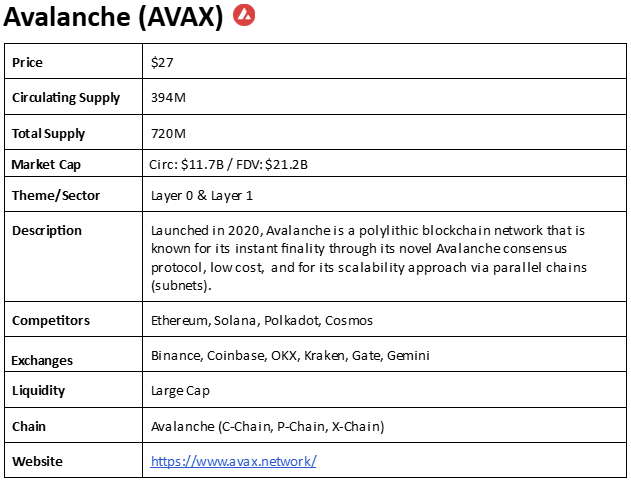

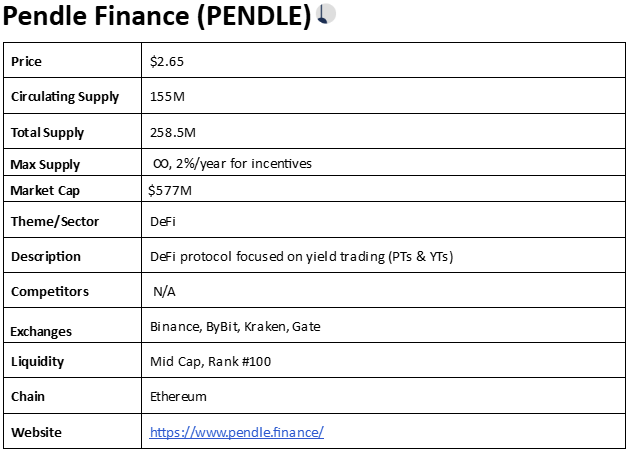

Crypto Research Reports

This past summer, I have created three digital asset research reports on Layer Zero, Avalanche, and Pendle, which I developed during my time at Arca. In my reports, I assess each token's Total Addressable Market (TAM), evaluate its industry standing, and provide a detailed analysis of its ecosystem and key use cases. I utilized valuation models to determine the potential upside, consider the team's background, relevant project investors, protocol technology, roadmap, community, usage metrics, and tokenomics. These reports aim to provide a comprehensive view of the digital asset landscape, helping investors understand the potential risks and rewards associated with each token.

Reach out to me if you want the reports in PDF!

I continue to post my investment research, trades, and market views on my Twitter, which you can follow here, and also on my Medium, available here.

Equity Research Reports

This semester, I have created two equity research reports on Amazon, a tech and consumer giant, and Robinhood, an innovative fintech brokerage platform. In my reports, I cover key financial metrics, industry trends, and competitive landscapes, providing in-depth analysis of their business models, growth strategies, and market positioning. I also assess their financial health through detailed valuation models, including DCF and comparable company analysis, while examining potential risks and opportunities that could impact future performance. These reports aim to offer actionable insights for investors, highlighting both short-term catalysts and long-term outlooks for each company.

Reach out to me if you want the reports in PDF!